NAD treasurer/CFO Judy R. Glass presents her treasurer’s report on Monday, November 4, 2024, the final day of the North American Division Year-End Meeting at the NAD headquarters in Columbia, Maryland. Photo: Art Brondo/North American Division

A series of meaningful worship moments — from a message of surrender to the Holy Spirit and an altar call to an impromptu congregational singing of “Come Thou Fount of Every Blessing” — set the stage for the treasurer’s report on the final day of the 2024 NAD Year-End Meeting.

As she took the stage on Monday, November 4, NAD treasurer and chief financial officer Judy R. Glass continued the focus on God as our source of strength and provider. “It’s amazing to see what the Holy Spirit is already doing in this room,” she stated.

Glass began by sharing upcoming and ongoing initiatives, highlighting Pentecost 2025, the NAD’s call for members and leaders to hold at least 3,000 proclamation initiatives. She noted that churches registered for Pentecost 2025 by November 30, 2024, will receive half of NAD funding through their unions by December or January. The remaining funds will come after completing their event and submitting a report.

She also praised the new Alive in Jesus Children’s Sabbath School curriculum for babies through age 18, quoting Brad Forbes, AdventSource president: “[Alive in Jesus] is a means to change the church's future dramatically.”

Other initiatives mentioned were the NAD’s strategic foci: media, mentoring, and mentorship, and missions to large cities under the Antioch Initiative.

Glass concluded her opening remarks by introducing a “new math” she had learned from General Conference treasurer Paul Douglas at the recent GC Annual Council. “One plus one is two, which we know, but one plus one to the power of the Holy Spirit equals amazing things.”

Meaningful worship moments, including an altar call by Atlantic Union Conference president Abraham Jules during his morning devotional, set the stage for the treasurer’s report on Monday, November 4, at the NADYEM. Pictured are NAD president G. Alexander Bryant, who is praying, along with Jules (to his left) and several NAD executive committee members and staff. Photo: Art Brondo/North American Division

Financial Highlights

Glass presented the NAD’s 2023 audited financial statement, highlighting an increase in operating and plant assets, which include cash, the NAD building, and other fixed assets. “We have total assets of $231.5 million and net assets of $162.5 million,” she stated.

“We ended the year with a $19,680,000 gain, which God certainly blessed us with,” Glass said, adding, “Overall, with our plant fund, it was about a $20.5 million gain.”

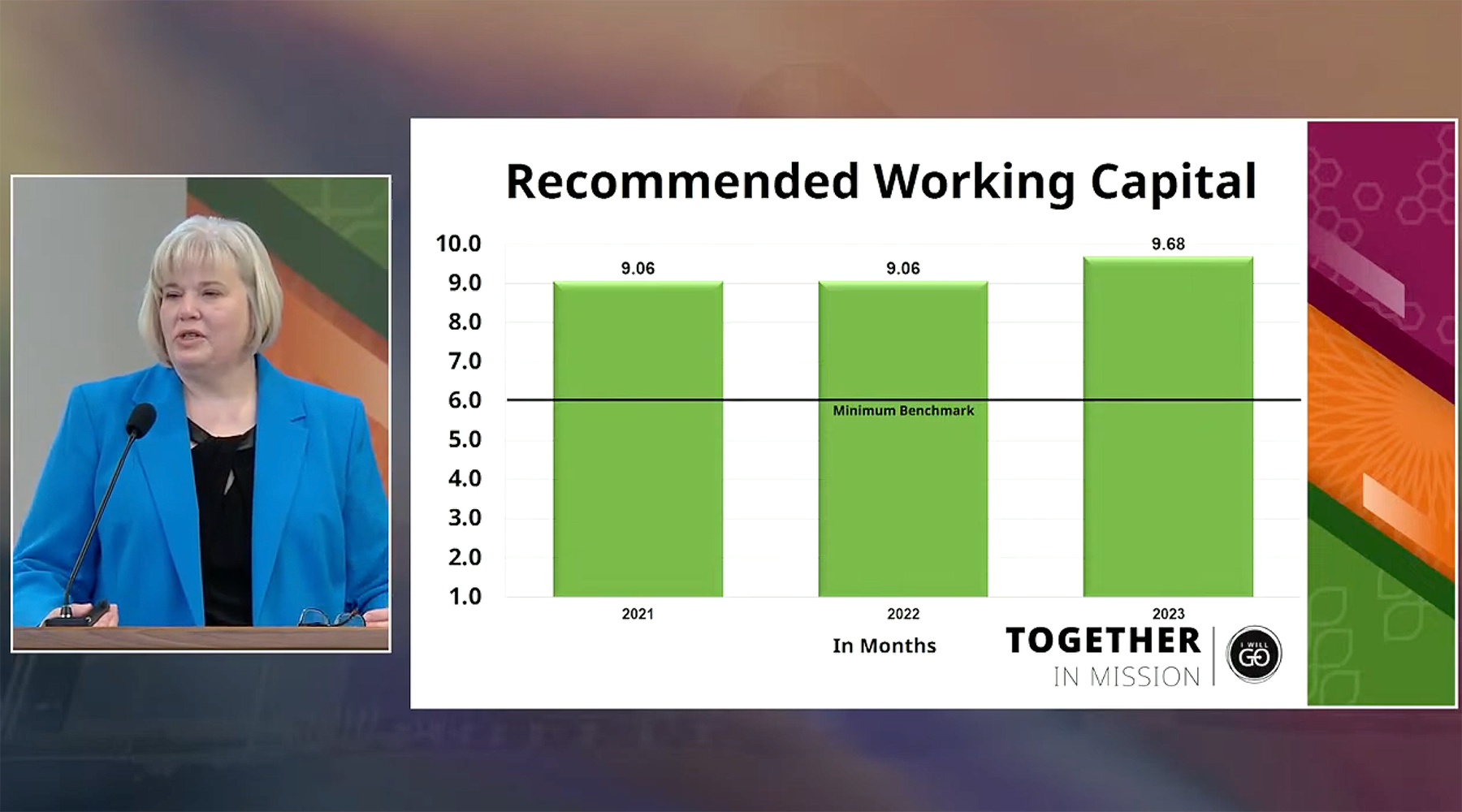

She then addressed working capital, or assets available for day-to-day operations. With a working capital of 9.68 months at the end of 2023, the NAD exceeded the six months recommended by the working policy.

During her 2024 NAD YEM report, NAD Treasurer/CFO Judy R. Glass addresses the NAD’s working capital, or assets available for day-to-day operations. With a working capital of 9.68 months at the end of 2023, the NAD exceeded the six months recommended by the working policy. Screenshot from livestream

“We're doing well in hitting this threshold, [which provides] funds for major initiatives and financial support for our unions and conferences,” Glass noted.

Glass shared another financial benchmark — days cash available — or how long the organization could cover expenses without additional income. In 2023, the NAD had 372 days cash available, down from 379 in 2022, but still strong.

Glass and others subsequently presented several reports, which the NAD YEM executive committee voted to approve.

NAD Audit Review Committee Report

Glass gave the NAD Audit Review Committee Report on behalf of Ken Denslow, Lake Union Conference president and chair of the committee that reviewed the audited 2022 and 2023 NAD unconsolidated financial statements. She noted that management was excused following the audit discussion so the committee could meet with the auditors privately.

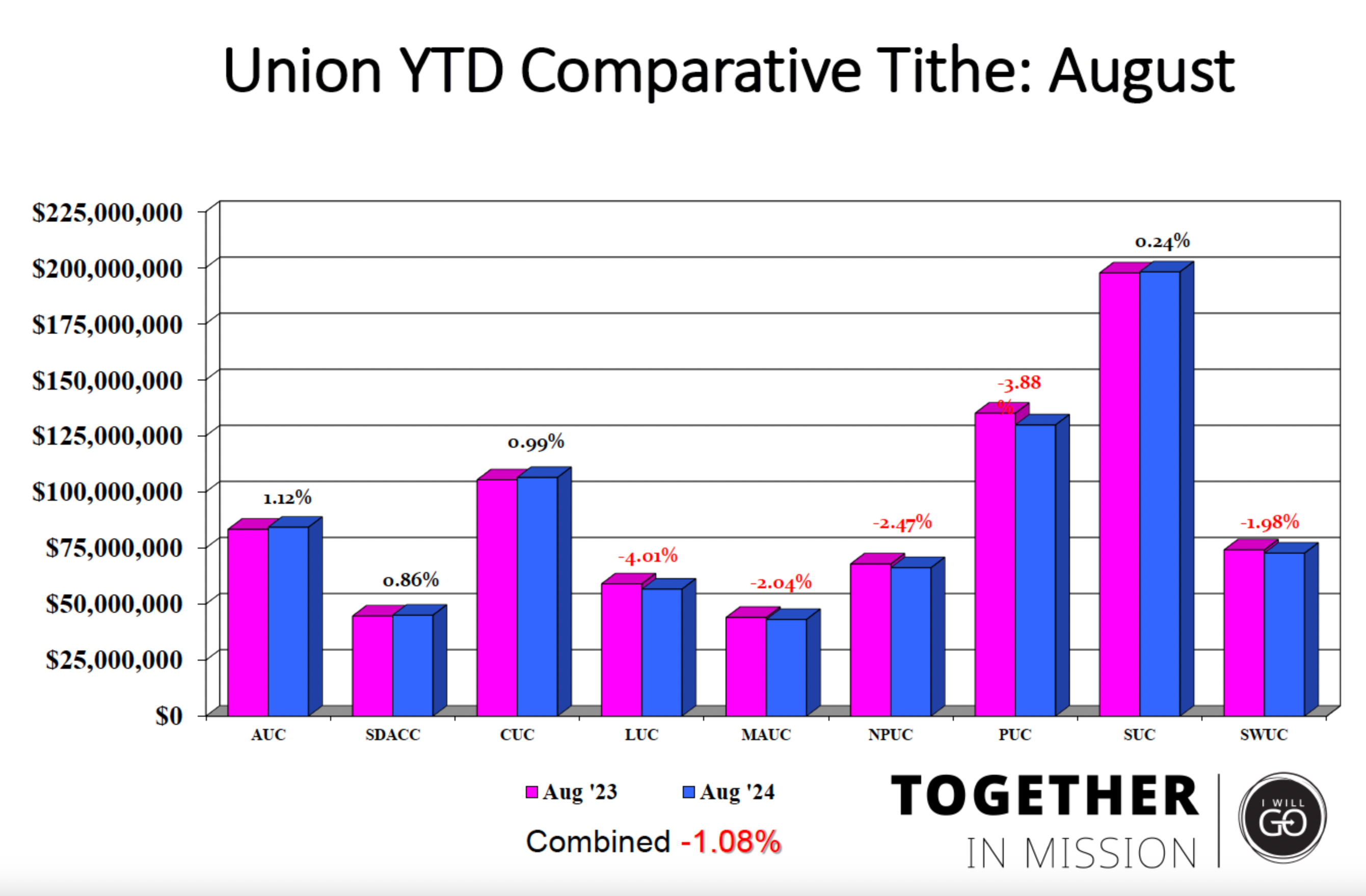

In her report, NAD treasurer/CFO Judy R. Glass shared that comparative tithe was down by 0.8 percent year over year through August 2024. However, overall, the NAD was in a strong financial position. Photo: screenshot taken from livestream

Year-to-date Unaudited Financial Statements

Transitioning to the year-to-date (YTD) unaudited financial statements, Glass painted a different picture than in 2023, when tithes increased across all nine unions. “At the end of August [2024], we were showing a 1.08 percent loss in tithe,” she said. Four of the nine unions exhibited gains, and the Atlantic Union led with a 1.12 percent increase.

“We’ve been running behind on our tithe all year, but remember that we’ve had multiple years of amazing tithe growth, … and in August, there were 34 Sabbaths instead of 35,” she said.

Glass shared that net tithe income surpassed the budget by $353,783, carefully distinguishing between budgeted and actual tithe.

In other gains, the NAD’s cash and investment totals are $124.5 million, a $16.4 million increase from 2023. “The stock market has been our friend, and we've been investing in treasury bills, which has been advantageous for us,” Glass explained.

Glass reported that the division has 198 days of cash available, which they calculate more conservatively than the General Conference Auditing Service (GCAS) auditors by excluding current liabilities and restricted net assets. This figure surpasses the target of 185 days, equal to half the 2023 expenses. Additionally, working capital stands at a healthy 8.64 months.

Reviewing the 2024 statement of changes in net assets, Glass noted that net income is $6.3 million, down from $8.1 million in 2023, but income from all sources exceeds the budget by $1.4 million.

Glass asserted, “We’re a little behind where we were last year, but given where we are with tithe, we’re in a very good financial position.”

From the August year-to-date expense summary, Glass highlighted that $12.1 million was allocated to church ministries, better than the budgeted $13.2 million, with total expenses $1.9 million under budget.

Among other financial indicators, the NAD has $72 million in cash, down from $81 million in 2023, but above the $65 million threshold. Also, daily income outpaces daily expenses by $10,000. “We’re in good shape here as well, and you’ll see [that] over the last four years, our income has been running ahead of our expenses,” Glass said.

Despite a tithe decrease, the reported indicators reflect the NAD’s financial strength.

Compensation Review Committee Report

Mid-America Union Conference president Gary Thurber presented the compensation review committee’s findings on compensation paid through December 31, 2023. They examined salary and travel budget audits for each NAD employee and found that “everything was in order.”

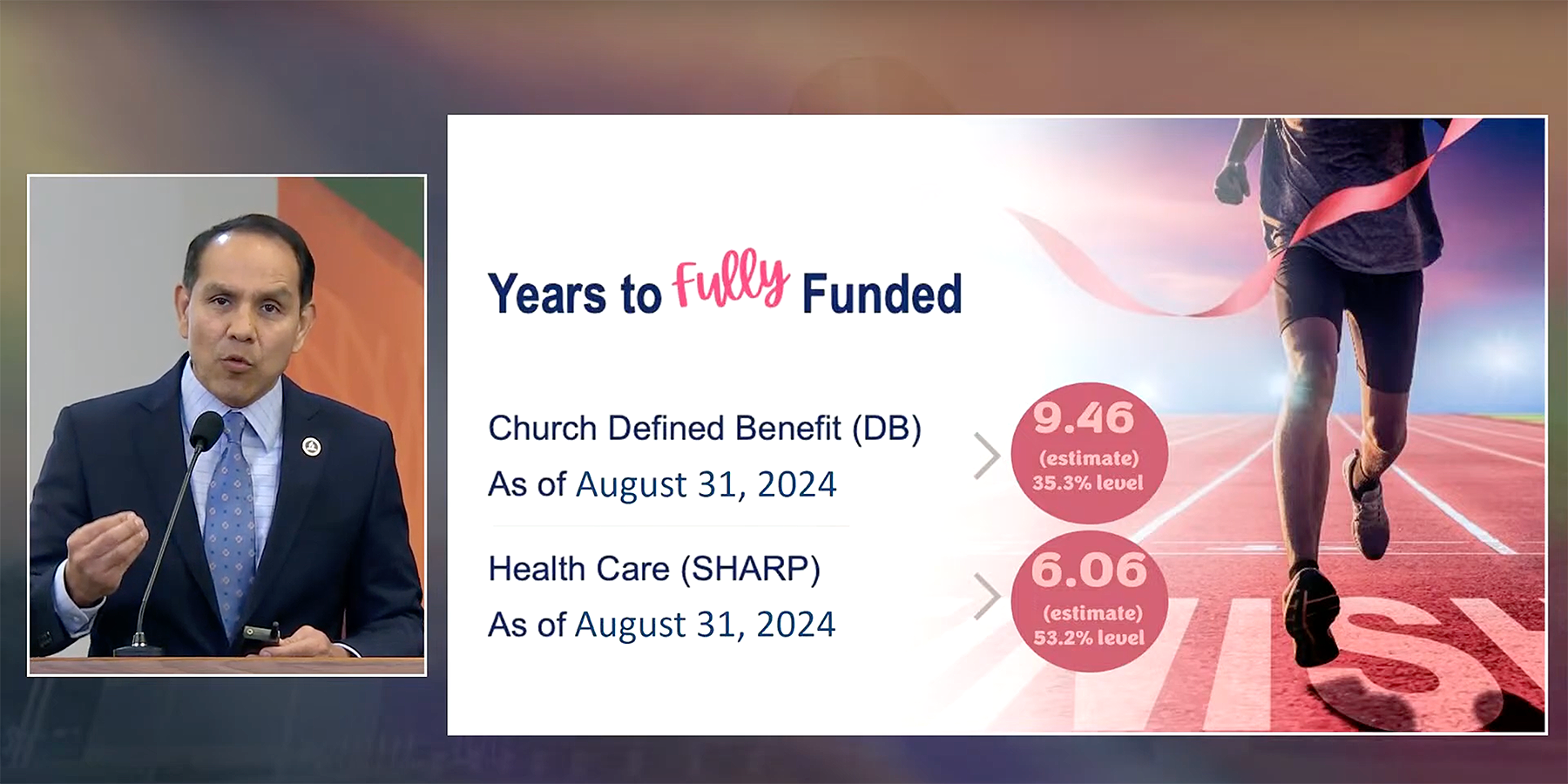

Edwin Romero, NAD Retirement plans administrator and associate treasurer, outlines the transition of the defined benefit plan from a 30-year pay-off to a 15.7-year funding timeline during the NAD YEM treasurer’s report. Photo: screenshot taken from livestream

NAD Retirement Plan

Edwin Romero, NAD Retirement plans administrator and associate treasurer, provided updates, first highlighting partnerships with reputable vendors, including Fortune 500 companies. He expressed that NAD Retirement witnesses to and prays for “each one of them.”

Next, he shared some noteworthy facts about NAD Retirement, including:

- The assets they manage exceed $3.4 billion, with $2.4 billion in the division’s defined contribution plan.

- They have 36,000 participants and serve more than 15,000 retirees.

- The operation is in the black.

Most impressively, Romero said, “We have never missed a pension payment since 1911.”

He also mentioned the Lilly Foundation Grant of $1.25 million, which they received to help “improve the financial literacy and financial behavior of our pastors across North America.”

Next, Romero outlined the transition of the defined benefit plan from a 30-year pay-off to a 15.7-year funding timeline.

“We’re praising the Lord that we’re just 9.46 years away from getting to a fully-funded status,” he said, adding, “For the health care plan, we have 6.06 years.”

Romero detailed auto-escalation for the defined contribution plan, which increased from seven to 15 percent, bringing total contributions between employer and employee to 23 percent for participants division-wide. “This is a new day for our participants. They don’t know it yet, but when they retire, they will be smiling,” he said enthusiastically.

He also underscored that NAD Retirement “always fights for lower fees because of the growth in the value of investments.” After submitting a request for a proposal for a recordkeeper last year, they expect to save $2.4 million over the next five years, which will benefit participants.

Finally, Romero reported that three years ago, they hired two full-time Certified Financial Planners who provide participants with customized financial plans at no additional cost.

He concluded, “We want to express appreciation to the Lord for everything He does for His church and for always watching over His people.”

The retirement report sparked discussion. Stephen Mayer, Pacific Union Conference treasurer, noted that nine years ago, the committee voted to increase conference contributions to the retirement fund from 8.1 to 8.4 percent. He asked that as the plan approaches total funding, the 0.3 percent be returned to conferences “to fulfill the mission differently.”

Glass said they would consider returning funds to conferences through a glide path. Responding to follow-up questions, Bryant said that at the pre-NADYEM administrators’ conference on October 30 and 31, conference and union officers agreed to reconvene to tackle retirement contributions and other issues, ensuring that “everyone would be part of the discussion.”

Invested Funds

Chad Grundy, NAD undertreasurer, gave the 2023 investment report. He shared that the NAD had grown the investment funds in their operating reserve from $56.4 million in 2022 to $57.9 million by the end of 2023 — a $1.5 million increase. They also allocated $5 million for long-term building depreciation funding instead of annual allocations, now totaling $5.2 million.

Grundy credited this success to using short-term treasury bills for fixed income return on investments, which earned 5.4 percent interest by December 2023. He added that the NAD will reevaluate asset allocations as interest rates change in 2025.

2025 Budget Assumptions

Grundy also presented the 2025 budget assumptions, noting it is a balanced budget based on 96 percent of the 2023 gross tithe. Unlike previous years, the 2025 budget does not assume a one percent tithe increase. It includes a three percent cost of living increase, to be implemented on July 1, 2025, and travel allowance budgeted at 106 percent of 2024 figures.

Funding priorities include $110,000 for the new Alive in Jesus Sabbath School curriculum training, $1.53 million for the 2025 GC session, and an up to $1 million appropriation to ARM for premium reductions. The budget also fully funds all NAD positions for a year. Finally, it incorporates using $2.44 million from existing fund balances.

Grundy reviewed other budget line items, noting that appropriations to organizations within our territory represent the NAD’s largest expense. He reported increases in all categories, with total budgeted costs rising from $135.5 million in 2024 to $145 million in 2025.

Finally, Grundy shared the following breakdown for the budgeted $1.27 billion gross tithe: the NAD will keep 13.9 percent, most of which provides appropriations and services for the field, and the conferences will retain the remaining 86.1 percent.

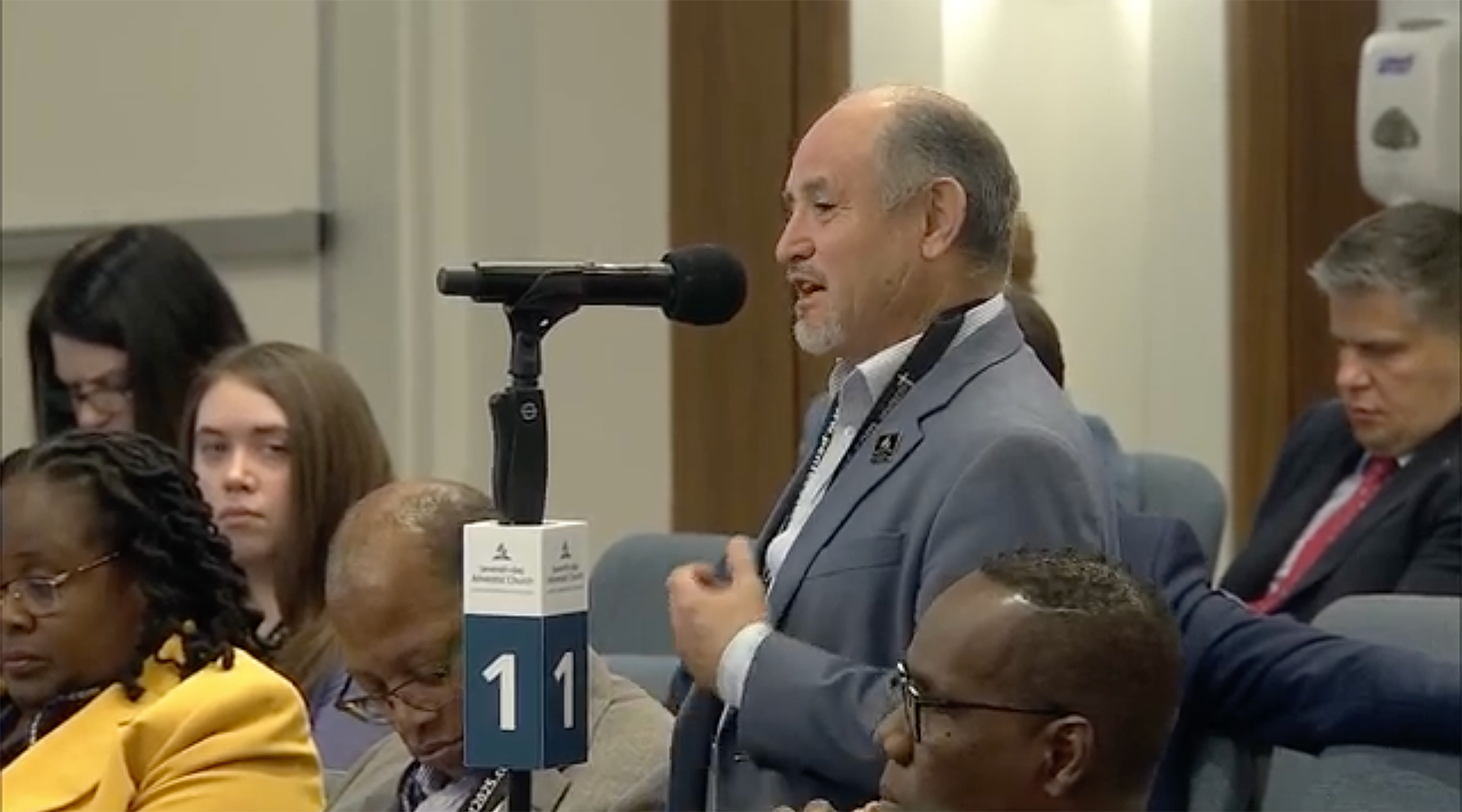

More discussion followed as Lee-Roy Chacon, Texico Conference president, expressed gratitude for the NAD’s financial gains while sharing his conference’s struggle to maintain even three months of reserve funds. “What’s the possibility of having more of that tithe money coming back to the conferences so we could do ministry at the local level?” he asked, visibly emotional.

Bryant responded that about four percent had been returned to the conferences from the General Conference for the last 12 years. He acknowledged, however, that it was not enough and additional solutions would need to be explored.

Click here to watch a video on tithe allocations, shared at last year’s NADYEM, and here for a report by retired NAD treasurer/CFO Randy Robinson.

Lee-Roy Chacon, Texico Conference president, comes to the mic during the Q & A following the budget segment of the NAD treasurer’s report during the NAD Year-End Meeting on Monday, November 4, 2024. Screenshot from livestream

Report from General Conference Auditing Service

In her report, JoJean Birth, associate director for GCAS in North America, shared that the church’s first audit and report traced back to May 1863, when the General Conference was organized. “Our church leaders recognize that the confidence and trust of our members is the greatest resource of the Seventh-day Adventist Church,” she said, continuing, “To date, the church’s commitment to transparency and accountability continues.”

Birth noted that in 2023, GCAS conducted 271 of the 291 audits they had committed to, with most conducted annually but trust engagements being triannual assignments.

Nearly 90 percent of North American Division audits received a standard or unmodified opinion, up from 86 percent in 2022. Additionally, 6.5 percent were modified, none received an adverse opinion, and only 3.5 percent were disclaimer audits (i.e., indicating insufficient financial information).

Birth also reported that 69 percent of NAD policy compliance reports violated at least one of the GC’s core policies, compared to the global non-compliance average of 80 percent.

As she closed, Birth expressed, “First Corinthians 12 reminds us that believers are united in the Lord, but God gives us different spiritual gifts to fulfill different kinds of service. Treasurers and auditors help ensure resources are available for the church’s front-line work.”

[Click here for the entire 2023 GCAS global annual report.]

Blessings

Among those hearing these reports were Tom Evans, retired NAD treasurer, and Douglas, GC treasurer, who offered support for Glass and the church’s unsung financial heroes. Douglas, coming to attend the NAD report in person from an overseas meeting, expressed appreciation for the positive report and lively discussion but stressed, “What’s most important for me is [Judy’s] first slide, where she started with mission. If it’s not about mission, it should not matter.”

Earlier, Glass thanked her team and joked: “Our budget is a lot like a sermon. No matter how long it is, people always wish there was more at the end.”

But the heart of her remarks was a promise on a slide titled “Blessings from God:” “Therefore do not worry about tomorrow, for tomorrow will worry about itself. Each day has enough trouble of its own” (Matt. 6:34, NIV).

“Let us remember that as we go forward. Sometimes we try [to] take the whole world, all the problems, on at one time, but we know God is walking with us each day, each step of the way.”

In closing, after a long morning of reports and voting on financial policy, Glass stated, “One final thing I want to remind us about is the Holy Spirit math: one plus one to the power of the Holy Spirit equals amazing things.”

[Click here to watch the complete treasurer’s report.]